Will the new bull market in Gasoline spark a Telecommuting Boom?

Just a thought that popped into my head after looking at the charts of NYMEX unleaded. No question that gas is in a new bull market, OPEC is even considering reducing oil output, although the real problem isn't crude, its refining capacity.

If you own a gas-guzzlin' ESS YOO VEE and drive it to work and back every day, and you're the only person in the car (at least that's what I see from the vantage point of my 29mpg Camry every day) then maybe you are thinking about this?

According to the experts, it's not that technology is an issue - it's your BOSS! From the Washington Post:

"Ronald F. Kirby, transportation planning director of the council of governments, said the main obstacle to teleworking is that some bosses worry about supervising workers 100 miles away. "There is a strong level of resistance by middle managers," he said, even though studies have shown employees are more productive when teleworking."

And more - -

"Private companies also are taking a second look at telecommuting. AeroAstro, an Ashburn-based satellite and space systems business, announced yesterday that it is urging its employees to telework at least one day a week because of the gas shortage caused by Hurricane Katrina.

Richard Fleeter, the company's president, said the policy, which will reduce employees' transportation costs by 20 percent, is a valuable recruiting tool. In a statement, he said the move would "attract to our work force the most highly talented people regardless of their geographic proximity to our home in Ashburn."

As an ex-stockbroker, I've learned that you can find out a lot more about what's going on in Dodge by eyeballing some good charts than by watching warm fuzzy "aren't we good citizens of the global economy" Exxon Mobil ads on TV.

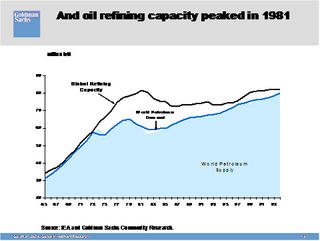

We have a very big supply-demand problem with gasoline products, and it has little to do with the price of oil. A quick look at the first chart shows that while global oil demand has been steadily rising, refining capacity isn't keeping up:

This next chart makes it even clearer. Capacity peaked in 1981, and the actual number of refinieries in production has declined to only about half what we had online 25 years ago! Why is this? Simple: the big oil companies and refiners figured out about 20 years ago that by not only refusing to build new refining capacity but by actually shutting down refineries, they could artificially affect supplies and make more profits. Does this make you mad, or would you just say "That's capitalism..."?

Meanwhile, real pump prices have actually declined somewhat from their 1981 peaks. For those who understand inflation, 1979-80 was when then Fed Chairman Paul Volcker decided "enough was enough" and stood on the brakes with both feet (which took some real balls, by the way). The reason real prices aren't as high as then is mainly because we don't have the kind of commodity inflation and interest rates we had then.

And another chart that clearly illustrattes that refining capacity is declining despite growing demand, with some more recent figures.

Finally, we can see that the real prices of oil and gold have reached a disparity from their peaks in 1980, indicating that either gold is underpriced (not likely) or that oil is overpriced. This could indicate that price pressure on oil is about to collapse (partly due to conservation by shell-shocked hordes of gas-guzzling SUV drivers), but it still doesn't solve the basic problem which is: If you want to lower the price of gas, you either have to produce more of it, or consume less of it. The choice is ours.

So what's the answer? Bill O'Reilly, who apparently just doesn't "get it" about economics, seems to think that Big Oil should just voluntarily "give up" 20% of their profits. Won't work. What could work is to give them a combination of carrot-and-stick incentives / tax breaks to actually create more refining capacity. And for God's sake - have enough strategic sense not to put it all in one place, like New Orleans, huh? But the bigger picture solution is simply to create new energy sources. You know what? Back in the late 1960's we were able to put men on the moon, and we can't even seem to get the picture about energy independence after 30 years of experience with being dependent on foreign oil, since our first big attack of oil -constipation back in 1974. You elected officials in Congress - this ain't rocket science, guys and gals. How 'bout it?

95% ethanol fuel stations in western nebraska. My dad saw it today. Apparently, you can be converters to run either this or normal gasoline at a whim. Not all that expensive and the 95% ethanol blend was slightly less than 87 grade gas. Just imagine what will happen when we put all that unused farm land to good use.

ReplyDeleteThe day of the towelheads is coming to a close...

Yes, I'm aware of that and the fact that Ethanol production has skyrocketed in the last 10 years. The problem is that US Politics hasn't kept pace, and isn't likely to do so because of the meatheads on both sides of the aisle in Washington...

ReplyDeleteI live in Texas & in a large city & MAN have I seen an increase in people riding the bus here. I guess it's ok but people can get attitudes when it's packed.

ReplyDeleteWell, the up side of this, coming from someone who drives a pickup to work now, is the fact that consumer demand, (the thing that drives our economy), is going to push for more fuel efficient vehicles and heavier use of alternative energies. Do I like high fuel prices, no (especially because it takes away from wine/beer budget), am I thankful for what they are doing in the long run, yeah.

ReplyDelete