Taking out a Second Mortgage to fill up that SUV?

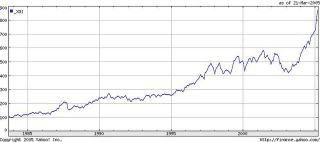

Taking a look at the Amex Oil Index Chart since 1985, you can see that the big spike at the end clearly doesn't reflect the real increase in demand, which has been relatively "regular" until about the middle of 2003 (year - over - year, for example from last year, only about a 2 percent increase). What you are seeing is a lot of oil futures traders have unusually low short positions, an indication that prices are peaking (that's correct, the majority of futures traders are exactly wrong around price extremes). So, don't take out a second mortgage to fill up your SUV just yet. Short Crude instead! You'll be able to make enough profit to be buying gasoline for a long time!

Amex Oil Index

Comments

Post a Comment